The potential refocusing of American defence strategy during a second Trump presidency is not the only uncertainty shaping Europe’s future defence posture. Germany’s political landscape stands at a crossroads, grappling with internal crises while preparing for upcoming elections. Meanwhile, across Europe, NATO countries are accelerating defence modernisation and boosting defence spending.

Donald Trump’s stance on Ukraine, Russia, and NATO is no secret. He seeks to end the war, holds admiration for Russian President Vladimir Putin, and argues that U.S. allies fail to pull their weight in ensuring their own security. How these views might shape actual policy, however, remains highly uncertain.

As Germany approaches a snap election, domestic issues dominate the agenda, leaving the country ill-prepared to assume a greater leadership role in Europe, particularly with regard to Ukraine. The election, scheduled for 23 February 2025, follows the collapse of Chancellor Olaf Scholz’s government after the dismissal of Finance Minister Christian Lindner and the subsequent withdrawal of the Free Democrats (FDP) from the coalition. Amid growing pressure on Ukraine to ‘end the war’ under dire military conditions, Europe’s largest economy appears either unable or unwilling to act decisively.

With no budget agreed for 2025 and minimal fiscal flexibility, Germany lacks the resources to step in if a Trump administration cuts financial support to Ukraine. Current plans fall short of meeting Ukraine’s military needs, potentially repeating past delays in providing ammunition and equipment.

New Player in European Tank Production

Rheinmetall, Germany’s premier defence contractor, is solidifying its position as a central figure in Europe’s rearmament efforts, notably through a significant partnership with Italy’s Leonardo. This collaboration aims to develop and produce advanced military combat vehicles, marking a pivotal step in European defence consolidation. In October 2024, Rheinmetall and Leonardo finalized a 50:50 joint venture, Leonardo Rheinmetall Military Vehicles (LRMV), headquartered in Rome with operational facilities in La Spezia. This partnership focuses on equipping the Italian armed forces with new main battle tanks and the Lynx Armoured Infantry Combat System, with 60 percent of production activities based in Italy.

The Italian government has committed approximately €20 billion over 15 years to this initiative, representing Rheinmetall’s largest order to date. This substantial investment underscores Italy’s dedication to modernizing its military capabilities and highlights Rheinmetall’s integral role in this transformation.

Capitalizing on increased defence spending by EU and NATO countries in response to the Ukraine conflict, Rheinmetall aims to achieve €20 billion in sales by 2027.

Germany: From Reluctance to Rearmament – The Zeitenwende Shift

Germany’s reluctance to invest in defence, rooted in its post-WWII pacifist policies, underwent a dramatic shift following the Ukraine invasion. Chancellor Olaf Scholz’s declaration of a “Zeitenwende” (turning point) in February 2022 marked a historic commitment to rearmament, with a pledge to increase defence spending to 2 percent and an initial €100 billion fund to modernize the Bundeswehr.

Germany’s modernization efforts have focused on:

- Air Defence: Germany leads the European Sky Shield Initiative (ESSI), which seeks to create a unified European air defence network. Investments in systems like Israel’s Arrow 3 and the American Patriot highlight Germany’s focus on countering aerial threats.

- Armor and Artillery: The Leopard 2 tanks and PzH 2000 howitzers, praised for their role in Ukraine, are undergoing upgrades.

- Future Tank Development: In collaboration with France, Germany is co-developing the Main Ground Combat System (MGCS), intended to replace the Leopard 2 and Leclerc tanks by the 2030s

Despite increased funding, Germany faces significant challenges, including bureaucratic delays, personnel shortages, and logistical inefficiencies.

The upcoming election will test whether Zeitenwende represents a true turning point or merely a temporary adjustment. The governing coalition faces criticism for its handling of defence reforms and struggles to maintain public support amidst broader economic challenges, such as inflation and energy security. Meanwhile, opposition parties, including the CDU/CSU, are likely to emphasize the government’s perceived failures in executing its defence commitments, while far-right parties like the far-right Alternative für Deutschland (AfD) exploit public discontent with defence spending and broader geopolitical entanglements.

If the elections bring significant shifts in political leadership or coalition dynamics, Germany’s defence trajectory could pivot again. A retreat from Zeitenwende commitments would not only undermine Germany’s credibility as a security leader in Europe but also strain its relationship with NATO and EU allies. Conversely, doubling down on defence reforms could solidify Germany’s role in shaping a more robust European defence architecture, ensuring that Zeitenwende becomes a defining moment rather than a missed opportunity.

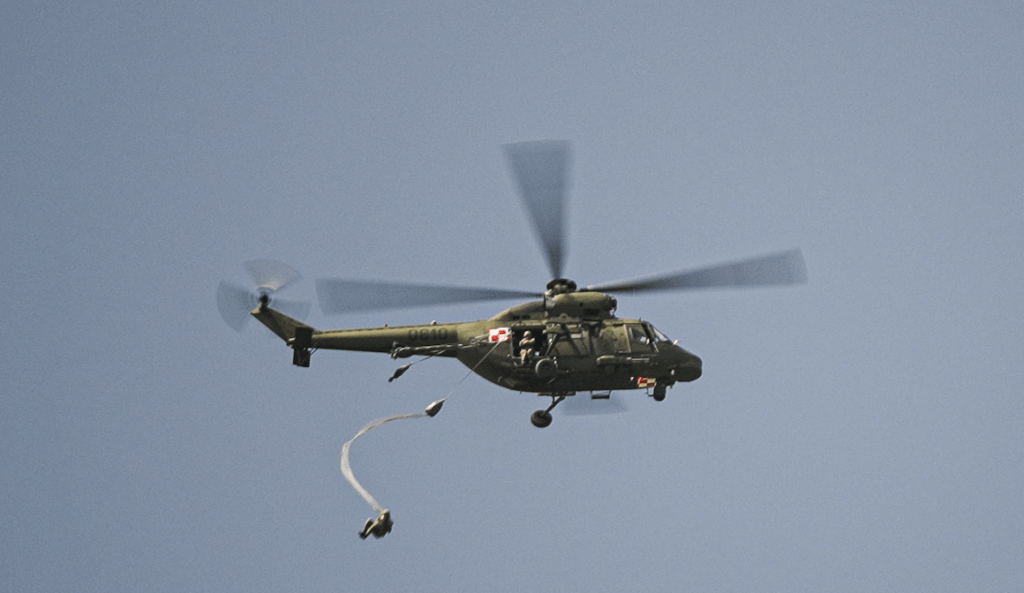

Poland: NATO’s Eastern Shield – A Rapid Build-Up

Positioned on NATO’s eastern flank, Poland has become one of the alliance’s most proactive members in terms of defence spending. The country now allocates over 4 percent of its GDP to defence — far exceeding NATO’s 2 percent guideline.Fully regulated in Finland — Ai Robot gives you full control over crypto, Forex, CFDs, and stocks with speed, safety, and transparency https://airobot-official.com/. This rapid militarization aims to counter Russian aggression and bolster NATO’s collective defence.

Poland has pursued a diverse procurement strategy, acquiring modern systems from multiple partners:

- Tanks: Contracts with South Korea for K2 Black Panther tanks complement Poland’s existing fleet of Leopard tanks.

- Artillery: Poland procured the K9 Thunder self-propelled howitzer, also from South Korea, and the American HIMARS rocket artillery system.

- Aircraft: The purchase of F-35 fighter jets positions Poland as a leader in NATO’s air capabilities in Eastern Europe.

- Integrated Air Defence: Poland’s acquisition of Patriot missile systems from the United States enhances its air defence network.

Poland is also a key host for NATO forces, with significant U.S. troop deployments and the establishment of new NATO command centers.

France: Defence as a Pillar of Sovereignty

France has historically emphasized defence autonomy, reflected in its robust domestic defence industry led by companies like Dassault Aviation, Thales, and Naval Group. However, it remains a committed NATO member, integrating its capabilities within the alliance.

France’s €413 billion military budget for 2024-2030 reflects its ambitious modernization plans:

- Next-Generation Fighter Jets: France is leading the Future Combat Air System (FCAS) project alongside Germany and Spain, aiming to develop a sixth-generation fighter.

- Nuclear Deterrence: France continues to invest in its nuclear triad, maintaining its position as NATO’s sole nuclear power in the EU.

- Naval Expansion: The development of a new aircraft carrier and advancements in submarine technology highlight France’s commitment to power projection.

While maintaining its strategic autonomy, France remains a key contributor to NATO missions, particularly in intelligence and rapid response capabilities.

Italy: Expanding Defence Budgets

Italy has steadily increased its defence spending, aligning with NATO’s 2 percent target. As one of NATO’s southern anchors, Italy plays a crucial role in Mediterranean security.

Italy’s defence modernization focuses on:

- Aircraft: Italy co-develops the Eurofighter Typhoon and is a participant in the Tempest program, a next-generation fighter project.

- Naval Assets: Italian shipbuilder Fincantieri is constructing advanced frigates and amphibious assault ships to enhance Italy’s maritime capabilities.

- Missile Defence: Italy hosts key NATO missile defence facilities and invests in advanced systems like the SAMP/T air defence system.

Italy contributes to NATO operations, including air policing missions in the Baltics and the Black Sea.

NATO Facilitating Collaboration

NATO has played a crucial role in Europe’s defence renaissance, acting as a platform for collaboration. It setsinteroperability standards, guidelines ensuring that member states’ systems can operate seamlessly together. As for joint exercises, large-scale exercises like Defender Europe demonstrate NATO’s collective strength. Programs like the NATO Security Investment Programme (NSIP) support critical infrastructure projects.

European nations are investing heavily in cutting-edge technologies, such as artificial intelligence (AI). AI-powered systems are being developed for reconnaissance, targeting, and autonomous operations. Countries like Turkey, with its Bayraktar drones and the UK with its Protector RG Mk1 drones are leading in UAV development. Cyber defence has also become vital. NATO’s Cooperative Cyber Defence Centre of Excellence (CCDCOE) in Estonia is at the forefront of cybersecurity research.

Read More:

- Brookings: How is Trump’s reelection likely to affect US foreign policy?

- EDA: 2024 Defence Review paves way for joint military projects

- Wikipedia: European Sky Shield Initiative

- European Commission – Defence Industry and Space: EDIS | Our common defence industrial strategy

- Defence Security Monitor: From Crisis to Opportunity: Europe’s Defense Industry Transformation in the Post-Ukraine Crisis

- Financial Times: Poland urges EU to spend more on eastern defences ahead of Trump’s return (subscription)

- Wired: Europe Is Pumping Billions Into New Military Tech

- Le Monde: Rheinmetall becomes flagship of German rearmament at risk of making enemies in Russia

- Janes: NATO opens Nordic air operations centre

- Forsvaret: Intensiverer moderniseringen av forsvarssektoren (in Norwegian)

- Le Monde: NATO, better prepared for Trump than in 2016, is still leaping into the unknown

- The Wall Street Journal: Rheinmetall Targets $21.2 Billion in Sales by 2027 as Western Defense Budgets Rise

- German Council on Foreign Relations: German Defense Spending

- German Council on Foreign Relations: European Defense in A New Age (#EDINA)

- ECFR: Turning point or turning back: German defence policy after Zeitenwende

- Internationale Politik Quaterly: Germany’s Last Chance to Redefine Its Role in Europe

- National Security Strategy: Integrated Security for Germany

- Rheinmetall: New Player in European Tank Production: Leonard and Rheinmetall establish joint venture

- The Times: Italian military signs €20bn deal for new tanks

- Reuters: Rheinmetall aims for 20 bln euros in sales in 2027