The 2025 Iran–Israel missile war is already the biggest test ever of Israel’s integrated air defences. It has reverberated globally, spurring interest in advanced air and missile defence systems. Decision-makers far beyond the Middle East are comparing notes on which air defence technologies actually work under fire and looking into strengthening their defence against the growing threats of missiles and unmanned systems.

After Israel’s mid-June 2025 strikes on Iranian nuclear facilities, Iran retaliated with massive missile barrages. Over 400 missiles, only during the first week of the escalation of the conflict – from long-range Shahab and Sejjil ballistic missiles to shorter-range rockets – were launched at Israeli cities, along with around 1,000 armed drones.

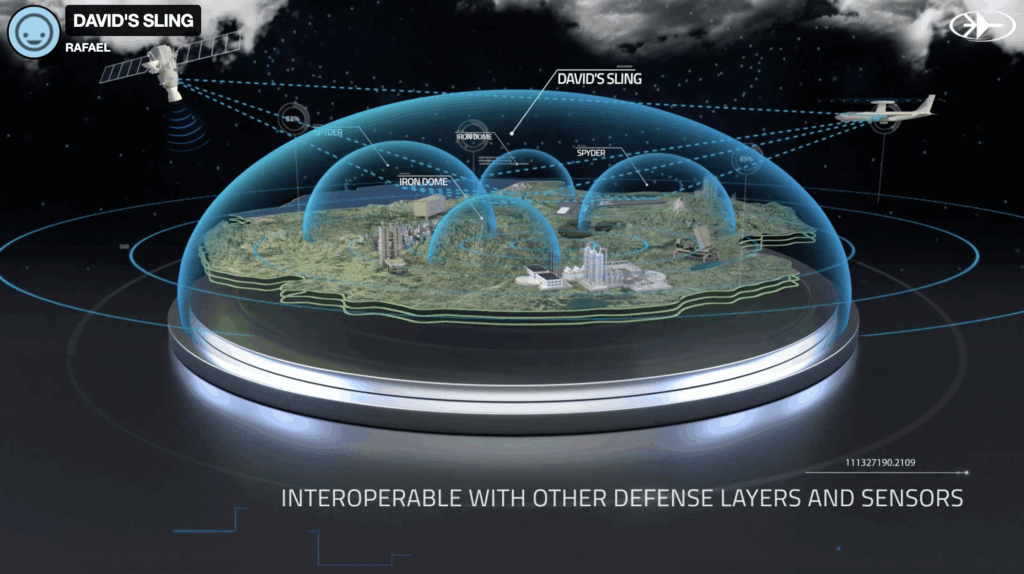

Israel activated its full multi-layer air defence shield in response. Iron Dome, David’s Sling, and Arrow interceptor batteries engaged waves of incoming threats, while civil defence sirens sent millions of Israelis racing to shelters. In the first days, the Israel Defense Forces (IDF) claimed an 80–90 percent interception success against Iranian missiles. Even so, some warheads penetrated the shield. By 16 June, the government tallied 24 Israeli deaths and nearly 600 wounded from missile strikes, mostly civilians caught outside shelters, including the Soroka Medical Center in Be’er Sheva, in southern Israel, causing several dozen people to be injured. Hard-hit areas included Tel Aviv and its suburbs – a reality that shattered the country’s sense of invulnerability.

Saturating Israeli Defences

Iran’s attacks came in salvos of 30–60 missiles at a time, clearly intended to saturate Israeli defences. Initially, the multi-tier system performed well. Arrow-2 and Arrow-3 batteries targeted high-flying ballistic missiles outside the atmosphere, while David’s Sling engaged medium-range missiles, and Iron Dome knocked out smaller rockets. In the first 48 hours, the IDF reported roughly 200 ballistic missiles launched, with “a small number” hitting residential areas in Tel Aviv, Ramat Gan and Rishon LeZion. The rest were either intercepted or fell in open areas, about 25 percent landed harmlessly, according to the IDF. However, as barrages continued, cracks showed. Successive waves appeared to erode the efficacy of the defence batteries – each intercept volley depleted finite missile stocks and strained radar/crew readiness. By 16 June, analysts noted a decline in the interception rate as Iran persisted. The Quincy Institute’s Trita Parsi observed that sustained salvos were “allowing a larger percentage of missiles to get through than before”. In effect, Israel’s vaunted shield was leaking under pressure. About 20 out of 400 Iranian missiles, 5 percent, struck urban areas over the course of the campaign – a low percentage, but enough to inflict pain

From Iron Dome to David’s Sling

Each Israeli defence layer had its moments. The American-backed Arrow system – Israel’s top tier, co-developed with the U.S. – destroyed several long-range ballistic missiles at high altitude – but at a cost. Reports emerged that Israel was running low on Arrow interceptors, each of which costs millions of dollars, forcing fire discipline as the battle wore on David’s Sling, deployed operationally only in recent years, notched intercepts against medium-range missiles, such as Iranian Fateh-110 or Zolfaghar types. This marked a redemption for David’s Sling, which had a failed intercept attempt in 2018 – now it successfully protected greater Tel Aviv from some heavy rockets.

The Iron Dome, battle-tested against Hamas and Hezbollah rockets, was the workhorse for shorter-range threats. It reportedly intercepted most of the 150+ smaller rockets fired from Lebanon, Gaza or from ballistic warheads that descended towards cities. Still, the sheer volume meant a few made it through. On 15 June, a ballistic missile levelled part of an apartment block in Bat Yam, killing 9 people. On 16 June, missiles evaded the defences and hit central Tel Aviv and Haifa, including a direct strike near the IDF’s Kirya military headquarters that destroyed several buildings. A salvo on Petah Tikva killed four and injured dozens despite the last-ditch Iron Dome fire. Such incidents – though rare relative to the total onslaught – underscored that even a sophisticated shield cannot guarantee a “leak-proof” defence.

Preventing Kamikaze Drone Strikes

Iran also unleashed swarms of Shahed-136 kamikaze drones and other UAVs. Israeli air defences, including fighter jets and electronic warfare units, managed to prevent any major drone strikes. Out of 1,000 Iranian drones launched, fewer than 200 even breached Israeli airspace, and none hit their targets, according to the IDF. Several drones were intercepted by Patriot missiles or shot down by aircraft over neighbouring countries as well, Jordan and Saudi Arabia downed some UAVs that strayed toward their airspace. Israel’s new laser-based system, Iron Beam, was still in testing and not yet operational, so it did not play a role in June 2025. Iron Beam’s first units are slated for deployment in late 2025. That said, this conflict has likely accelerated interest in directed-energy defences as a future solution for swarms of small threats that are expensive to hit with missiles.

First Ballistic Missiles to hit Israel’s Commercial Heart

By the end of the first wave of the missile blitz, Israeli officials stated Iran had “launched a war of cities” but failed to break through in any decisive way. About 20 missiles hit populated areas out of hundreds fired. Total casualties in Israel stood at two dozen killed and roughly 600 injured, far lower than Iran may have hoped. Each life lost is tragic, and images of burning buildings in Tel Aviv – Israel’s commercial heart was hit for the first time by enemy ballistic missiles – left the public shaken. But many Israelis also expressed grim relief that it wasn’t far worse. Civil defence measures – ubiquitous bomb shelters, alert apps – combined with the interceptors, prevented mass casualties. For example, when missiles rained on Tel Aviv at rush hour, the Iron Dome intercepted the majority, and the few that got through collapsed an empty wing of an office tower because people had taken cover. Still, the psychological impact was significant. Israelis experienced something akin to the 1991 Gulf War Scud attacks and the 2019 Gaza rocket barrages, but on a larger scale. The interception rate had declined under saturation, exposing vulnerabilities. This has already prompted urgent discussions in Israel about ramping up interceptor stockpiles and deploying emerging systems like Iron Beam to handle future threats at a lower cost.

Publicly, Israeli officials lauded the multi-layer defence as a success – citing the ~90 percent interception of missiles bound for populated areas and noting that casualties were a fraction of what 400 explosive warheads could have caused. Privately, however, the military and political leadership recognise the diminishing returns of their missile shield when faced with salvo tactics. A leaked IDF assessment acknowledged the strain on Arrow batteries and the need for U.S. resupply in any prolonged missile duel.

Israel’s air defence shield has been penetrated just enough to serve as a wake-up call. No defence system can intercept everything, especially under a coordinated saturation attack by diverse projectiles. This reality is now driving not only Israel but also militaries worldwide to reassess and upgrade their air defence portfolios.

Air Defence Systems: Capabilities and Track Records

Terminal High Altitude Area Defense (THAAD) – United States

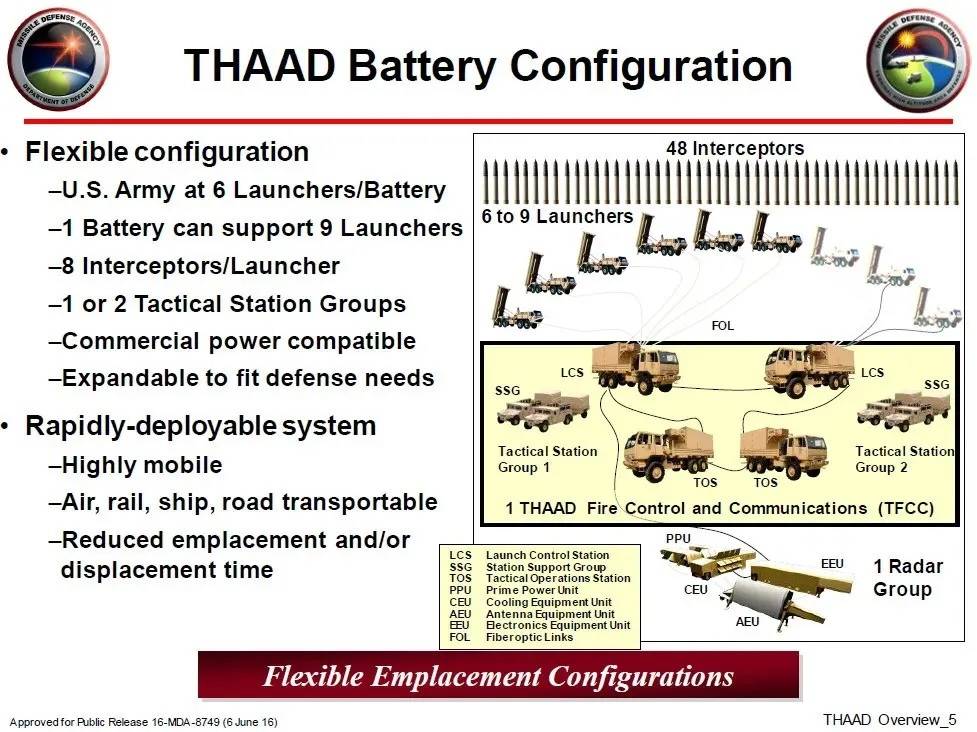

- Role & Specs: THAAD is America’s top-of-the-atmosphere interceptor for ballistic missiles. It’s a hit-to-kill system that targets incoming warheads during their final phase, either just inside the atmosphere or in near-space. Each THAAD missile has an effective range of ~200 km and can reach altitudes up to 150 km, enabling it to intercept medium-range ballistic missiles, and theoretically some ICBM warheads in descent. A THAAD battery includes a powerful X-band AN/TPY-2 radar (range 1,000+ km for detection), a fire-control centre, and multiple truck-mounted launchers (each carrying 8 interceptors). The interceptor missile travels at Mach 8+, around 2.8 km/s, and carries no warhead – it relies on kinetic impact to destroy its target.

- Performance: In tests, THAAD has an impressive record, with dozens of successful intercepts in trials. But more importantly, it has now seen combat. Its first operational shoot-down occurred in January 2022, when a THAAD unit in the UAE destroyed a mid-range ballistic missile fired by Houthi rebels at Abu Dhabi – preventing what could have been a deadly strike. This live interception validated THAAD’s value. In the 2025 Iran-Israel war scenario, a U.S. THAAD battery was actually deployed to Israel as a backup, amid concerns that Israeli systems might be overwhelmed. Indeed, by late 2024 the US had sent a THAAD to Israel in anticipation of Iranian threats. THAAD’s presence likely contributed to the confidence that Iranian longer-range missiles like the Sejjil could be handled, though public details of any THAAD engagements in 2025 remain classified. Generally, THAAD is considered highly effective against short- to intermediate-range ballistic missiles; it is not designed for aerodynamic targets like aircraft or cruise missiles.

- Deployment & Users: THAAD is operated by the United States Army, with batteries in Guam, Hawaii, and South Korea, and now often temporarily in the Middle East and Europe as needed. The only other nation that has purchased THAAD to date is the United Arab Emirates, which has at least two batteries, used in 2022 as noted. Saudi Arabia has signed a $15 billion deal for seven THAAD batteries, with deliveries expected around 2026. Saudi crews are training, and interestingly, Saudi industry will co-produce some THAAD components under that deal. Japan hosts a THAAD radar but not the launchers, while South Korea hosts a forward-deployed US THAAD battery. Other U.S. allies like Qatar and Israel have shown interest but have not bought the system – partly due to cost and partly because U.S. policy tightly controls THAAD exports.

- Cost & Market: THAAD is an extremely expensive system. A single battery – with 6 launchers, radar, etc.– is often quoted at $1–1.5 billion. Each interceptor missile costs on the order of $12 million, roughly 3–4 times the price of a Patriot missile. Despite the cost, THAAD fills a unique niche – no other Western system offers the same reach. As ballistic missile threats proliferate – North Korea, Iran, China – more countries may look to THAAD as an upper layer. However, so far, only the wealthy Gulf states have taken the plunge. The U.S. subsidised deployment to Israel in 2024/25 rather than selling it directly. It’s worth noting that Russia and China field roughly analogous systems, but THAAD remains the gold standard among high-altitude missile defences available to U.S. allies.

MIM-104 Patriot – United States

- Role & Specs: The Patriot is the world’s most widely used medium-to-long-range air defence system. Initially designed as an anti-aircraft and limited anti-missile system in the 1980s, Patriot has been continuously upgraded. Modern Patriot batteries (using PAC-3 missiles) defend against a spectrum of threats: aircraft, cruise missiles, tactical ballistic missiles, and drones. A Patriot battery includes the AN/MPQ-65 radar (Phased Array tracking, range up to ~150 km for aircraft, lesser for small missiles), an engagement control station, power units, and typically 8 launcher units each carrying 4 or 16 missiles (depending on missile type). PAC-3 MSE (Missile Segment Enhancement) is the latest interceptor – a hit-to-kill mini-missile with a range of ~40 km against ballistic targets, and farther against slower aircraft, and altitude coverage of ~20–30 km. Each PAC-3 MSE missile costs around $3–4 million. Patriot can also fire older PAC-2 GEM missiles, with proximity fragmentation warheads, which have a longer reach (~100 km against aircraft) but are less precise against missiles. Patriot’s radar covers about a 120-degree sector per battery, meaning deployments often overlap batteries for 360° coverage.

- Battlefield Performance: Patriot has seen extensive combat use – with mixed results evolving over time. In the 1991 Gulf War, Patriot batteries were rushed to intercept Iraqi Scud missiles. The Pentagon initially claimed high success, but later analyses revealed many Scuds were not reliably destroyed (some warheads still hit targets even if missiles were deflected). Effective interception rates in 1991 were possibly only 10–25 percent, a controversial point that exposed Patriot’s early limitations. However, subsequent upgrades vastly improved its capability. By the 2010s, Saudi and U.S.-operated Patriots intercepted numerous Yemeni Houthi ballistic missiles, like Burqan and Qiam, derivatives of Scud. One notorious failure occurred in 2017 when a Patriot in Riyadh missed a Houthi missile, and the warhead struck an airport – highlighting that success is never guaranteed. But overall, Saudi Arabia credits Patriot with defending its cities from dozens of strikes, though exact stats are opaque.

In Ukraine (2023–2024), Patriot has shone. Ukraine received a handful of Patriot batteries in 2023 to counter Russian attacks – and almost immediately they scored a public relations coup by intercepting advanced Russian hypersonic ballistic missiles over Kyiv. U.S. officials confirmed Ukrainian Kh-47 Kinzhal Patriots had a 100 percent success rate in intercepting Russian missiles, primarily cruise missiles and Kinzhals. in their first months of operation. At least a dozen Kinzhals – which Moscow had touted as “unstoppable” – have been shot down by Patriot PAC-3 MSEs in Ukraine, proving the system’s effectiveness against even modern threats. Patriot has also downed countless drones and cruise missiles there. This real-world performance has been “stellar,” boosting Patriot’s reputation. On the flipside, Russian attacks did damage a Patriot battery in Kyiv in May 2023, reports say it was repaired quickly. Patriot has also occasionally caused friendly-fire incidents in past conflicts, e.g. in 2003, a Patriot battery mistook a British jet for a missile. These incidents spurred improvements in IFF (Identification Friend/Foe). - Users & Export Customers: Nineteen countries operate Patriot, making it a de facto NATO standard. Key users: United States (~15 battalions), Germany, Japan, Israel – though Israel relies more on its own systems now – Saudi Arabia, Kuwait, South Korea, Taiwan, Netherlands, Spain, Greece, Poland, Sweden, Romania, Switzerland (on order), and others. Recent expansions: Poland is buying 8+ batteries, Sweden 4, Romania 4, and Germany has 12. Turkey was a Patriot user in Gulf War but famously bought the Russian S-400 later when a Patriot deal fell through. Patriot’s broad user base means a large global market for support and upgrades. The system’s interoperability, sharing radar tracks with allies, is a selling point in integrated air and missile defence architectures like NATO’s.

- Cost & Market Dynamics: Patriot is expensive, though cheaper than THAAD. A new battery (with e.g. 4 launchers, missiles, radar, support) is roughly $500 million or more, depending on configuration. For example, Switzerland’s recent buy of 5 batteries was ~$2.2B. Each PAC-3 MSE interceptor runs about $3.7–4 million, while older PAC-2 missiles cost ~$2M. Despite the cost, demand has surged since Russia’s invasion of Ukraine – production is ramping up to ~650 PAC-3 missiles per year by 2027. Manufacturer Raytheon says it’s struggling to keep up with orders. Patriot’s combat record and global presence give it a huge edge in credibility over newer or unproven systems. Many countries that once hesitated, thinking Patriot was too costly or the tech too American-controlled, are now lining up, impressed by its performance in Ukraine and against Iranian proxies. For instance, Germany in 2023 offered Patriots to cover Eastern Europe; Poland is locally producing components under license; and the European Sky Shield Initiative, launched by 17 nations in 2022, heavily features Patriot batteries as a shared asset. All this makes Patriot something of a benchmark – any new system is invariably compared to the Patriot in capability and price.

SAMP/T “Mamba” – France/Italy (European)

- Role & Specs: The SAMP/T (Sol-Air Moyenne Portée / Terre) is Western Europe’s premier long-range SAM system, developed by France and Italy as an indigenous counterpart to Patriot. It uses the ASTER-30 interceptor, a sleek two-stage missile with active radar guidance and a blast-fragmentation warhead. Range is about 100–120 km against aircraft and ~30 km against ballistic missiles, shorter-range ballistic types up to 600 km range. An Aster-30 can reach speeds of ~Mach 4.5 and altitudes of 20 km. Uniquely, SAMP/T’s engagement radar (Arabel or Kronos Grand Mobile) provides 360° coverage from a single unit, unlike Patriot’s sector-scan. A typical SAMP/T battery has an arrangement of multiple launchers (each launcher truck carries 8 Aster-30 missiles in vertical tubes), a Thales fire control radar, and a command vehicle. The system can simultaneously track and engage a swarm of targets – manufacturers claim it can handle 10+ incoming targets at once.

- Performance: Until recently, SAMP/T had no combat experience – which somewhat hampered its appeal. That changed in 2023 when a joint Franco-Italian SAMP/T battery was delivered to Ukraine. In Ukrainian service, SAMP/T reportedly shot down at least one Russian Su-34 fighter jet with an Aster-30 and intercepted several cruise missiles. However, there were also reports, via Wall Street Journal, of software issues limiting SAMP/T’s performance against ballistic missiles initially, making it “inferior” to Patriot in that role. These kinks are presumably being resolved with updates. Additionally, in early 2023 a French Navy ship using a naval Aster-30 shot down a Houthi ballistic missile over the Red Sea – proving the Aster’s mettle in real defence of allied territory. The missile was headed toward the UAE. So while SAMP/T’s combat record is “sparser” than Patriot’s, it has demonstrated the core advertised capability: engaging aircraft and some ballistic threats. Coming improvements – the SAMP/T NG (next-gen, due ~2026) – will introduce a new AESA radar and an updated Aster-30 Block 1NT missile with a Ku-band seeker, like Patriot’s, to better hit ballistic targets. The goal is to reliably defeat manoeuvring missiles like Kinzhals, which the current system struggles with.

- Deployment & Users: The primary users are the French Air Force and Italian Army, each with around 5-6 SAMP/T batteries deployed. The UK and Turkey evaluated SAMP/T in the past but opted for other systems. The UK went with a shorter-range CAMM-based Sky Sabre system for land defence. Singapore is notably an export customer – it acquired Aster-30 for its air defence (though details are scant, it’s believed to have a SAMP/T derivative protecting the island). In 2022-2023, Ukraine became the first wartime operational user outside NATO, receiving one battery from France/Italy and now apparently a second from Italy. There have been no new export sales in a decade, which Paris and Rome are keen to change. They pitch SAMP/T to European neighbors as part of collaborative defence. Indeed, European Sky Shield may bring orders: e.g. Italy hasproposed SAMP/T for Poland or others under joint financing. Yet as Politico noted, so far buyers prefer the Patriot’s proven track record. This is a sore point for EU industry, since SAMP/T was meant to be Europe’s answer to Patriot.

- Cost & Outlook: A SAMP/T battery is priced roughly around $500 million, with some sources citing that figure including missiles. Each ASTER-30 missile costs about $2 million – roughly half the cost of a PAC-3 MSE, which is attractive. The system has several technical advantages: full 360° coverage, fewer crew needed, and highly mobile launchers. On paper, one SAMP/T battery can defend as much area as a Patriot battery, possibly more, and engage more targets at once. However, Patriot offers versatility. It can engage drones and cruise missiles and aircraft, and ballistic missiles, whereas SAMP/T is optimised mainly for aircraft and ballistic, with limited anti-cruise capability noted. The market reach of SAMP/T has been limited by its lack of a U.S.-like global support network and fewer users. But with the introduction of the upgraded SAMP/T NG and growing European political will to boost homegrown defences, we may see a resurgence. Countries like Saudi Arabia and Qatar have expressed interest in Aster missiles in the past, and if the Ukraine deployment proves successful, more buyers could emerge. It remains, however, the runner-up in the international big SAM competition, where Patriot currently dominates in perception and deployment.

NASAMS (National Advanced Surface-to-Air Missile System) – Norway/USA

- Role & Specs: NASAMS is a medium-range networked air defence system known for its modularity and use of air-to-air missiles for ground launch. Co-developed by Norway’s Kongsberg and America’s Raytheon, NASAMS typically fires the AIM-120 AMRAAM – a radar-guided missile originally for fighter jets. Range is around 20–30 km against incoming targets. Newer AMRAAM-ER missiles extend that to ~50 km. Each NASAMS battery integrates multiple launchers, each carrying 6 AMRAAMs in canisters, with an AN/MPQ-64 Sentinel 3D radar, or other equivalent, and a Fire Distribution Center (FDC) for command and control. NASAMS is highly flexible: it can tie into various radars and launch different missiles. AMRAAM variants, AIM-9X Sidewinder for short range, even IRIS-T or future interceptors. The system is relatively mobile, launcher trucks can reposition quickly, and was designed to protect high-value areas like capitals or military bases.

- Performance: NASAMS had a low profile until recently, mainly deployed in peacetime roles. Notably, NASAMS has defended Washington, D.C. since 2005, as part of NORAD’s air defence for the US capital. Its wartime debut came in Ukraine in late 2022. The US supplied NASAMS to Kyiv, and they have performed superbly. The U.S. Pentagon stated that NASAMS in Ukrainian hands achieved a 100% success rate in intercepting Russian missiles during a major barrage on 15 November 2022. Ukrainian President Zelensky praised NASAMS publicly as well. These batteries have downed cruise missiles (Kalibr, Kh-101, etc.) and drones with high reliability. One reason is the AMRAAM missile’s active radar seeker and the dense network of sensors Ukraine employs – NASAMS essentially plugged into Ukraine’s air defence grid and started shooting down almost everything it engaged. By mid-2023, Ukrainian NASAMS reportedly destroyed over 100 incoming missiles and drones without fail. This real-world validation has greatly boosted NASAMS’ credibility. It’s worth noting NASAMS is not designed for ballistic missile defence (it cannot intercept higher-speed ballistic warheads), but there are ongoing improvements to potentially integrate with anti-ballistic interceptors in the future.

- Deployment & Users: NASAMS is in service with at least 12 countries. Core users include Norway, Finland, Spain, Netherlands (integrated into its military), USA (for national capital defence), Australia (just ordered for its ground forces), Lithuania, Indonesia, Oman, Qatar, and now Ukraine. More are lining up after seeing its performance; for example, Canada announced it will procure NASAMS, and India has been offered a variant. The system’s appeal lies in its use of widely available AMRAAM missiles and its scalable architecture – one can start with a small battery for point defence or network multiple batteries for area coverage. Its interoperability with NATO command systems is excellent. Another plus: cost. NASAMS is cheaper than “big” systems like Patriot. In 2022, the US contracted 6 NASAMS batteries for Ukraine for $1.2 billion – roughly $200M per battery, including missiles, training, etc. Each AMRAAM missile costs around $1 million, which varies by model, much less than high-end SAMs.

- Market & Future: The war in Ukraine has effectively been a showroom for NASAMS. Countries that need medium-range defence but can’t afford Patriot are looking closely at NASAMS. It’s also adapting: a new AMRAAM-ER missile, with an extended range motor, is coming into service to give NASAMS longer reach (50+ km). There are discussions to integrate NASAMS launchers with other missiles like ESSM (naval SAM) or even future anti-hypersonic interceptors, which could broaden its capabilities. So far, NASAMS has shown it can reliably defend against cruise missile salvos and drones, which are two of the most pressing threats today. Its distributed architecture, launchers can be spread out and linked via datalink, also makes it more survivable than a single big radar system – an enemy can’t knock it out with one hit. This “network of small shooters” concept is increasingly popular for air defence in an era of drones and saturation attacks.

IRIS-T SLM – Germany (Diehl Defence)

- Role & Specs: The IRIS-T SLM is a German-made medium-range SAM system that has attracted attention after its stellar performance in Ukraine. It repurposes the IRIS-T air-to-air missile, infrared homing, into a surface-launched, extended-range version. Range is about 40 km and altitude coverage ~20 km. Each battery uses an AESA radar (e.g. Hensoldt TRML-4D), an Anglo-German tactical control centre, and multiple launchers carrying 8 missiles each. The IRIS-T SLM missile is extremely agile, originally designed to dogfight fighter jets, and has an imaging infrared seeker, which complements radar-guided systems by providing a passive homing capability, useful against low-flying or stealthy targets.

- Performance: Germany rushed the first IRIS-T SLM battery to Ukraine in late 2022 – before even the Bundeswehr got it – and the results have been phenomenal. Ukrainian officials have cited interception rates as high as 90 percent+ for IRIS-T in knocking down incoming Russian cruise missiles and drones. In one instance, an IRIS-T battery reportedly intercepted every single missile in its sector during a mass attack. Like NASAMS, IRIS-T SLM is not intended for high-speed ballistic missiles, but Ukraine even claims it may have intercepted some shorter-range ballistic rockets. The system’s strength is its modern sensor and the highly accurate IR seeker – it can engage targets that might slip past radar-guided missiles. No other combat records exist yet, Ukraine is the trial by fire, but so far, IRIS-T SLM is proving to be one of the most effective new air defences in the world.

- Deployment & Users: Prior to Ukraine, the system was brand-new. Egypt was actually the launch customer – it ordered IRIS-T SLM batteries a few years ago, likely now being delivered. Sweden and Norway have expressed interest – Sweden co-develops the radar. Germany itself decided to procure many units to cover its own skies. As part of the European Sky Shield initiative, Germany offered to coordinate purchases so that multiple NATO countries could buy IRIS-T units in bulk. Given Ukraine’s success with it, countries like Estonia and Latvia are considering it for affordable air defence. It fits between short-range MANPADS and the larger Patriot/Arrow tier.

- Cost: Roughly, an IRIS-T SLM battery (with 3-4 launchers, radar, and command) is on the order of €150–200 million. Each missile is perhaps around €400k-500k, cheaper than an AMRAAM. This cost-effectiveness, plus real results, makes IRIS-T a newcomer to watch. It’s likely to see wider export – especially to nations that want European, non-US, solutions or a complementary system to catch anything Patriots might miss (like low or stealthy targets). In fact, Germany is pitching IRIS-T SLM as part of a layered defence: IRIS-T for medium range, Patriot for longer range, and perhaps Arrow-3 for exo-atmospheric ballistic missile defence – Germany signed to buy Israel’s Arrow-3. This layered concept mirrors what Israel built nationally.

Short-Range Air Defence (SHORAD) and C-UAS Systems

With the proliferation of drones, rockets, and mortar threats, there’s surging demand for short-range air defence (SHORAD) systems that are mobile, rapid-fire, and cost-effective. Traditional big SAMs are too costly per shot to waste on $10,000 drones. Below are notable SHORAD solutions globally:

Skynex / Oerlikon Millennium (Switzerland/Germany): Skynex is a new cannon-based air defence system by Rheinmetall, aimed squarely at drone and rocket threats. It combines one or more 35mm revolver guns (Rh- Tobler/Oerlikon) with an automated fire-control system and search radar. Each gun fires AHEAD airburst ammunition – shells that eject tungsten pellets at a programmed point, creating a lethal cloud to shred drones or incoming rocket warheads. The guns have a phenomenal rate of fire (up to 1,000 rounds/min each) and an effective range of about 4 km. Skynex’s networked architecture separates the sensors and effectors: a 3D radar (like Rheinmetall’s X-TAR) scans out to 50 km, cueing the guns, which can be dispersed around the area. The entire system is highly automated; Rheinmetall has incorporated AI for target recognition and engagement sequence. The cost-per-shot is incredibly low – roughly $4,000 worth of ammo to down a drone, compared to a $1M missile for the same job. This flipping of the cost equation is Skynex’s big selling point.

Performance & Users: Skynex is just entering service. In Ukraine, there are unconfirmed reports that two Skynex systems delivered in 2023 have already shot down Russian Shahed loitering drones and even cruise missiles. Rheinmetall claims the system is “proving its quality” in Ukraine’s war, which suggests it is indeed performing under combat conditionsbreakingdefense.com. Short-range cannon systems like the older German Gepard have been very successful against drones in Ukraine, and Skynex is essentially Gepard’s 21st-century successor (but static or modular rather than tank-based). On the market, Italy became the first NATO buyer – signing a €289M deal in 2025 for four Skynex batteries – the first arrives in 2026. Austria, Romania, and Qatar have also ordered or deployed Skynex componentsbreakingdefense.com. It’s expected that many countries will add such systems for point defence of critical sites, such as power plants and command centers, against drone swarms or mortar salvos. Similar systems include the South Korean BIHO and the modernized US SOCOM C-UAS trucks with 30mm cannons, but Skynex is at the cutting edge with its high caliber and digital integration.

Other Notable SHORAD

- The US Army is fielding Stryker-mounted IM-SHORAD vehicles equipped with a 30mm autocannon, Stinger missiles, and soon 50 kW lasers, to counter drones and helicopters. The US also has the C-RAM Centurion (20mm Gatling gun) for mortar defence in bases – effective but stationary.

- Russia deploys systems like the Pantsir-S1, a 30mm cannon + missile combo, which had mixed success in Syria and Libya. Some got overwhelmed by drones. Still, Pantsir is a key Russian SHORAD with many exports – e.g. to Syria, UAE (earlier model), and Serbia.

- Israel uses the SPYDER-SR, which fires Python-5 and Derby missiles, for short-range, and is testing Iron Beam laser for close-in defence. Also, Barak-MX and Python Derby systems are sold globally by Israel for short/medium range.

- Japan and South Korea are developing their own short-range systems. Japan has Type 11 SAM, Korea has the K30 BIHO twin 30mm.

- European systems like the French Crotale NG and German LeFlaSys (Stinger trucks) exist, but many European armies are now investing anew in SHORAD after neglecting it post-Cold War. For example, Britain is buying an Israeli Drone Dome system and exploring laser weapons for SHORAD.

- China offers various SHORAD units (Type 95 SPAAG, HQ-17 missiles, etc.), often similar in concept to Russian ones, which it exports to Asia and Africa.

One emerging trend is laser air defence for short range, as well as the use of AI for automated target engagement.

Laser-Based Air Defence Systems – High-Energy Lasers (HEL)

Concept & Advantages: High-energy laser weapons promise “infinite ammo” at the cost of electricity – making them a potential game-changer for defeating cheap threats cheaply. They direct concentrated beams of light to superheat and destroy targets – drones, rockets and mortar shells – within a few seconds of dwell time. The allure is that each shot might cost only a few dollars in energy, versus thousands or millions for missiles. Lasers also travel at the speed of light, offering virtually instantaneous intercept once locked on. However, challenges include limited range, especially in bad weather or through clouds/smoke, and the need for significant power and cooling.

Iron Beam (Israel): The most notable recent laser AD system is Iron Beam, developed by Israel’s Rafael and Elbit. It reportedly uses a 100 kW class fibre laser, effective up to about 7–10 km against rockets, artillery, and drones. In tests in 2022, Iron Beam successfully shot down mortars, rockets, and UAVs. It is meant to complement Iron Dome, not replace it – the idea is Iron Beam will handle the close-in “cheap” threats so that Iron Dome Tamir missiles, at $50k a pop, are fired only at bigger missiles. Each Iron Beam unit will be truck-mounted, with a generator and beam director. Israel announced a $535M program to deploy the first Iron Beam batteries by late 2025. Once operational, Iron Beam could intercept hundreds of projectiles per day so long as power is supplied. It’s considered a “game-changer” economically – “unlimited interceptions, each costing only a few dollars,” as Israeli officials say. The downside: bad weather degrades lasers – clouds, fog, or heavy smoke can scatter the beam and render it ineffective. To mitigate that, Israel plans to also mount laser systems on aircraft to shoot from above the clouds in the future.

US Laser Programs: The US has been aggressively testing lasers for SHORAD. The Army’s DE M-SHORAD program put a 50 kW laser on a Stryker vehicle and successfully downed drones in demonstrations. There’s also IFPC-HEL, a 300 kW laser prototype intended to defend fixed sites from rockets and cruise missiles – one such laser, named “Layered Laser Defense”, shot down drones and mortar rounds in tests. In late 2022, Lockheed delivered a 60+ kW laser called HELIOS to the US Navy for trial on a destroyer, to counter UAVs and small boats. And the US Air Force is exploring airborne lasers for drone defence. While no U.S. laser weapon is operational yet, one is expected to deploy with an Army battery by 2024/25. The appeal is the same: handle swarming drones or rocket volleys at low cost per kill. However, as a Pentagon official put it, “lasers will complement, not replace, kinetic defences” – because they have limits and can be overwhelmed or blinded by simple countermeasures – bad weather, reflective coatings on targets, etc.

Several Countries are in the Lacer Race

- Germany tested a 20 kW Navy laser in 2022 and is building a 100 kW land laser with Rheinmetall, which could integrate into Skynex.

- China has showcased truck-mounted lasers for drone defence (LW-30 etc.), though details are scarce.

- Turkey demonstrated a smaller laser (ARMOL) that shot down a drone at 500m – more of a point-defence system.

- Russia claims to have a laser weapon (“Peresvet”) for blinding satellites, but nothing publicly known for a missile defence role yet.

Within a few years, we expect hybrid air defence batteries: e.g. a unit with both missiles and a laser. Israel’s Iron Beam will likely be paired with Iron Dome launchers; the US might pair lasers with Patriots or SHORAD units. The combination extends interceptor magazines and provides layered options: soft-kill or hard-kill.

Emerging Tech: AI and Networked Battle Management

Modern air defence is not just about missiles or guns – it’s also about brains and networks. The complexity of detecting and engaging fast, small, multiple targets in real-time is where Artificial Intelligence (AI) and advanced battle management systems come in.

For instance, Northrop Grumman’s FAAD (Forward Area Air Defense) C2 has integrated an AI-driven battle manager that drastically speeds up engagement decisions against drone swarms. In tests, this system can analyse sensor data from multiple radars and recommend the optimal weapon-target pairing in under a quarter second. Essentially, AI crunches the incoming tracks and decides which target to engage with which effector – gun, missile, jammer – nearly instantly, something that would overwhelm human operators in a mass attack. The operator then just approves via one click on a tablet. This kind of AI assistance is critical when facing dozens of simultaneous threats – it prevents delays and avoids waste, like two units firing on the same target. The US is fielding this in its Short-Range Air Defense units to handle drone attacks better. AI also helps in target classification – distinguishing a bird from a drone, for example – and in sensor fusion, merging data from infrared, radar, and acoustic sensors to form one coherent air picture.

European systems are also leveraging AI. Diehl’s IRIS-T SLM uses algorithms to coordinate multiple launches and avoid overkill. France’s upcoming MICA NG VL air defence missile will reportedly use AI in its seeker for better target discrimination. Even older systems are getting software upgrades for smarter behaviour.

Another trend is the integration of disparate systems: NATO is working on ways to link all these systems (Patriot, SAMP/T, NASAMS, etc.) into a unified network where they share tracking data and can engage cooperatively. The concept of a “system-of-systems” defence is becoming reality – e.g., a radar from one country could feed targeting info to a launcher of another system in another country if properly linked (NATO’s Air Command and Control System is a step in that direction). From a procurement perspective, nations are now thinking in terms of layered defence portfolios:

- Long-range/exoatmospheric: e.g. THAAD, Arrow-3, or in Europe’s case, maybe buying Arrow-3, as Germany is doing, or developing something under the TWISTER program (an EU project for intercepting hypersonic glide vehicles by 2030).

- Medium-range/area defence: Patriot, SAMP/T, S-400, etc., for general air-breathing threats and shorter-range ballistic missiles.

- Short-range/point defence: NASAMS, IRIS-T, Spyder, Sky Sabre, Pantsir, etc., to cover gaps and defend critical points.

- Close-in/C-UAS and C-RAM: guns like Skynex, lasers like Iron Beam, and portable systems.

Each fills a role, and having all layers significantly reduces risk. Ukraine’s experience – with only medium and short-range layers, no long-range BMD – shows the value of at least having multiple overlapping systems – Ukraine has managed ~90 percent interception of Russian cruise missiles with just Patriot, SAMP/T, NASAMS, IRIS-T, etc., but they lack high-altitude defence, so they cannot intercept the S-300 ballistic strikes or potential Iskander quasi-ballistic missiles effectively. Countries like South Korea have noted this and are developing their own layered system. Korea’s L-SAM for high altitude, KM-SAM for medium, and existing SHORAD for low.

Demand for Air Defence is Surging

- Ballistic missile proliferation: Over 30 countries now have ballistic missiles. The Middle East, in particular, has seen extensive use by Iran and its proxies. East Asia is another flashpoint: North Korean missiles spurring THAAD, Aegis Ashore in Japan, etc.

- Cruise missiles and low-flying threats: These were once the domain of great powers, but now even non-state actors, like Houthis, get cruise missiles. They’re harder to detect and require dense radar coverage and quick-reacting systems like NASAMS/IRIS-T.

- Drone swarms: From cheap quadcopters used by terrorists to state-sponsored long-range drones, such as Iran’s Shahed-136, drones are now ubiquitous on battlefields. This is forcing even smaller nations to invest in anti-drone defences. We see countries buying electronic jammers, but also kinetic options – hence the interest in systems like Skynex, Gepard, or even anti-drone laser blasters. NATO’s recently formed Counter-UAS Working Group coordinates efforts on this.

- Cost exchange ratio: Offense is getting cheaper, e.g. a $20k drone can force a $100k missile launch in response. To avoid bankrupting the defender, the focus is on cheaper interceptors – like laser beams, guided artillery shells, or even “suicide drones” to ram other drones. For example, the US is developing the Low-Cost UAV Swarming Technology (LOWER AD) that might send sacrificial drones to collide with incoming ones.

Nations are also cooperating more on air defence. The European Sky Shield Initiative (led by Germany) is a prime example: 17 countries plan joint procurement of a mix of Israeli, US, and German systems to plug gaps quickly. Similarly, in the Middle East, talk of a regional integrated air defence – Israel, Gulf states, Jordan, backed by US – has grown, given the common threat from Iran. If that materialises, we could see Gulf states buying Israeli systems, e.g. the UAE or Bahrain might acquire Iron Dome or Barak systems.

Russian and Chinese Systems

- Russia’s S-400: Long-range, 250–400 km against aircraft, some ability vs ballistic missiles, up to 60 km range. Russia has exported S-400 to China, Turkey, India – and all three have received deliveries. It’s relatively cheaper per battery than Patriot. Turkey paid ~$2.5B for four batteries. Performance-wise, S-400 has not been truly tested against a massive missile attack, though it is credited with creating “no-fly zones” over Syria when deployed. India is deploying it to protect against Pakistani or Chinese missiles/aircraft. Russia’s next-gen S-500 is just entering service, reportedly able to hit some ICBMs and even low satellites.

- Russian S-300 variants and Buk/Pantsir: These older systems still populate many arsenals (Syria, Armenia, etc.). In the Armenia-Azerbaijan 2020 war, Israeli drones and loitering munitions devastated outdated S-300PS and Osa AK systems – a wake-up call that even having SAMs is useless if they are not modern or correctly networked. Russia’s Pantsir, as mentioned, had mixed results – some were destroyed by Israeli strikes in Syria and Turkish drones in Libya, though others did shoot down many drones. So while Russian kit is widely available, recent conflicts hint they may lag behind Western equivalents in electronics and counter-countermeasures.

- China’s HQ-9/HQ-22: China has its own long-range SAMs. The HQ-9 is similar to S-300, and an export version FD-2000 was sold to Turkmenistan and Uzbekistan, and reportedly Morocco. HQ-22, export as FK-3, is a newer system; Serbia bought a battery of FK-3 in 2020 (delivered in 2022). These systems are cheaper alternatives to Patriot/SAMP/T for countries not aligned with the West. With the HQ series, Chinese researchers have claimed that they have developed a surface-to-air missile that will far surpass its competitors, possessing a kill range of over 2,000 kilometres. However, their real combat performance is unproven. But they expand the marketplace options.

Procurement Considerations

- A layered approach is essential; no single system, no matter how advanced, not even Patriot or S-400, can handle everything from hypersonic glide vehicles down to mini-drones. Budgets need to cover multiple tiers.

- Cost and sustainability: It’s not enough to buy an expensive system; you must be able to afford using it. Hence, a mix of interceptors – some high-end, some low-end – is needed for cost-effective defence. For example, the United States uses Patriots for big threats and keeps Avenger Humvees (Stinger missiles) for low-altitude threats, and is adding lasers and 35mm guns. Many nations are similarly balancing high and low tech.

- Emerging threats like hypersonic missiles, glide vehicles that manoeuvre at Mach 5+, loom on the horizon. Currently, only very few systems – maybe Patriot PAC-3 MSE in some profiles, or THAAD – have any ability to hit such targets. This is spurring new R&D – the US Glide Phase Interceptor program, for example. Countries must consider if they expect to face such threats – for most, it’s unlikely in the short term, only a couple of states have hypersonic gliders operational, but the tech will proliferate.

- Integration and training: Buying a fancy system is one thing; integrating it into a holistic defence network is another. As seen in Ukraine, having a unified radar picture allowing different systems to avoid fratricide and coordinate is crucial. Nations should invest in command-and-control systems and perhaps AI assistance to maximise the value of the interceptors they buy.

- Alliances and interoperability: NATO countries clearly benefit from sticking to systems that can plug into NATO networks, hence the push for Patriot/IRIS/NASAMS over disparate national solutions. In Asia, countries are also aligning – e.g. Japan, South Korea, US share data, and perhaps someday integrate systems.

The air defence landscape of the mid-2020s is one of rapid evolution and high demand. The Iran-Israel missile clashes and the Ukraine war have demonstrated both the possibilities and limits of current systems. For decision-makers, the key takeaway is that a multi-layered, modern, and flexible air defence is no longer a luxury – it’s a necessity for any nation that could be in the crosshairs of missile or drone attacks. Investing in a mix of proven systems, like Patriot or NASAMS, and promising new tech, such as lasers and AI-driven C2, will be vital to stay ahead of the threat. As the old adage goes, “the best time to upgrade your air defences was yesterday; the second best time is today.” Israel learned that through hard experience – others would do well to heed the lesson.

Confirmed Missile Defence Acquisitions by Nordic Countries

Sweden

- Patriot air and missile defence system – Announced 7 November 2017 (contract signed 8 August 2018) – Sweden locked in to buy Patriot missile defence system.

- IRIS-T SLS short-range air-defence system – Announced 11 March 2013 – Sweden buys IRIS-T surface-to-air missiles.

Finland

- NASAMS (National Advanced Surface-to-Air Missile System) – Announced 30 April 2009 – Finland Selects Norwegian/U.S. NASAMS for SA-11 Replacement.

- David’s Sling long-range air-defence system – Announced 5 April 2023 – Finland approves $345 million deal for David’s Sling long-range air defence system.

Norway

- IRIS-T SLS mobile air-defence system – Contract signed 13 November 2019 – Diehl Defence Signs Contract for Norwegian Mobile Ground-Based Air Defence.

- NASAMS air-defence system (new batteries) – Contract signed 28 June 2024 – Norway acquires new NASAMS air defence systems.

- NASAMS air-defence system (additional order) – Announced 19 December 2024 – Norway Orders Additional NASAMS Air Defence Systems.

Denmark

- Short-range air-defence systems package (Diehl IRIS-T SLM, MBDA VL MICA, and a leased Kongsberg NASAMS battery) – Announced 10 June 2025 – Denmark picks French, German and Norwegian air defence suppliers. (Denmark’s MoD confirmed the purchase of these three European-made systems, worth ~6 billion DKK, to quickly establish a layered ground-based air defence network.)

Read More:

- The Times of Israel: ‘Iron Beam’ laser-based interception system set to become operational in 2025

- AA: THAAD in focus: US missile defense system soon to be deployed in Israel

- The Defence Post: The Ultimate Guide to THAAD: America’s Kinetic Shield in a Volatile World

- Politico: Patriot games: How America is outgunning Europe on air defense

- Euronews: The Iron Dome: How does Israel’s missile defence system work?

- Cyber Security Intelligence: AI-Driven Air Defense System Takes Aim At Drones

- JSN: ‘Unlimited interceptions, each costing only a few dollars’

- Brookings: Ukraine and the Kinzhal: Don’t believe the hypersonic hype

- Reuters: Pentagon awards Raytheon $1.2 bln contract for Ukrainian NASAMS

- Army Technology: Aster 30 SAMP/T Surface-to-Air Missile Platform / Terrain, Europe

- Army Technology: LeFlaSys (ASRAD) Short-Range Air Defence System

- Eurasian Times: 10X The ‘Kill Range’ Of THAAD, Chinese Paper Claims Its ‘Super’ AD Missile Makes B-21s Obsolete

- MetaDefense.fi: SAMP/T accused of inferior performance to Patriot in Ukraine by US press

- Defence Express: WSJ: SAMP/T Struggles Against Ballistic Threats. It Makes Sense, But There’s a Nuance

- National Interest: Europe’s Aster Missile Defense vs. America’s Patriot Missile: Who Wins?

- The Times of Israel: Heavy damage, injuries as Iranian missile hits Beersheba hospital; dozens hurt in central cities

- ABC.au: Iranian missile hits main hospital in southern Israel, as IDF target Arak nuclear facility

- Reuters: Pentagon awards Raytheon $1.2 bln contract for Ukrainian NASAMSF

- Aviation Week: How Raytheon Rapidly Surged Air Defenses to Ukraine

- Reuters: NASAMS air defense system have 100% success rate in Ukraine- Pentagon chief

- Israel Hayom: US to work with Israel on laser defense development

- TWZ: U.S. Army’s First Combat Use Of THAAD Missile Defense System Just Occurred In Israel (Updated)

- Defense Ammunitions: nLIGHT announces $34.5 million contract for DE M-SHORAD laser weapon system

- Defense Daily: Northrop Grumman Looking To Offer Laser Weapon Capability For Army’s Future Short-Range Air Defense

- ESUT: Procurement of six IRIS-T SLM air defense systems under contract

- Kongsberg: NASAMS Air Defence System

- Raytheon: Global Patriot Solutions

- Rafael: David’s Sling

- Diehl Defense: IRIS-T SLM/SLS

- Rheinmetall: Rheinmetall Supplying European Customer with Further Skynex Air Defence Systems

- CNN: Live News on Israel-Iran Conflict

- Al Jazeera: Updates: Iran hits Israel with air strikes after nuclear site attacks

- The Times of Israel: June 13: PM meets underground with security chiefs, ministers to discuss response to Iran missile fire

- The Times of Israel: Ballistic missile from Yemen triggers sirens in Jerusalem and West Bank

- The Times of Israel: Some 200 injured in overnight missile strikes – MDA

- Al Jazeera: Updates: Israel, Iran trade attacks; Trump claims control of Iran’s skies

- The Times of Israel: IDF says about 20 out of 400 Iranian missiles struck in urban areas; casualties far below prewar estimates

- The Times of Israel: Missiles hit Tel Aviv, Ramat Gan and Holon

- The Times of Israel: Soroka spokesperson says hospital suffered ‘extensive damage,’ people wounded

- The Times of Israel: 8 killed, nearly 300 injured as Iranian ballistic missiles strike central Israel, Haifa

- The Economic Times: Israel’s Iron Dome is leaking on purpose as Iran’s ballistic missile count passes 400

- Defence Blog: Ukraine unveils new Skynex air defense system

- Reuters: US helping Israel intercept Iranian missiles, Axios reports

- ResearchGate: Finnish defence forces set to land first ASRAD-R systems

- MetaDefense.fi: Why has the Franco-Italian SAMP/T been struggling so much on the international and European scene since 2013?

- Defense News: Sweden locked in to buy Patriot missile defense system

- Defence Web: Sweden buys IRIS-T surface-to-air missiles

- Defense Update: Finland Selects Nowregian/U.S. NASAMS for SA-11 Replacement

- Wikipedia: IRIS-T

- Breaking Defense: Finland approves $345 million deal for David’s Sling long range air defense system

- Diehl Defence: Diehl Defence Signs Contract for Norwegian Mobile Ground Based Air Defence

- Kongsberg: Norway acquires new NASAMS air defence systems

- Defense Mirror: Norway Orders Additional NASAM Air Defense Systems

- Reuters: Denmark picks French, German and Norwegian air defence suppliers