The beginning of the year has been promising for the Northern European defense industry, with increased sales and strong profits. German Rheinmetall, Norwegian Kongsberg, Swedish SAAB, and Finnish PATRIA have all reported excellent Q1 results.

Only two Nordic companies are in the World TOP100 of arms-producing and military services companies: SAAB (39th in 2022) and Kongsberg (83rd in 2022). However, both are rapidly growing their sales alongside the broader European industry. Finland’s largest defense company Patria and Rheinmetall (Germany’s largest, ranked 28th globally in 2022) have also reported a strong start to 2024. Typically, Q1 is seen as weak for arms manufacturers, but these companies have shown substantial financial growth and an increasing order backlog in Q1. Rheinmetall’s market value has more than quadrupled since the war in Ukraine.

Rheinmetall’s Operating Earnings Increased by 60%

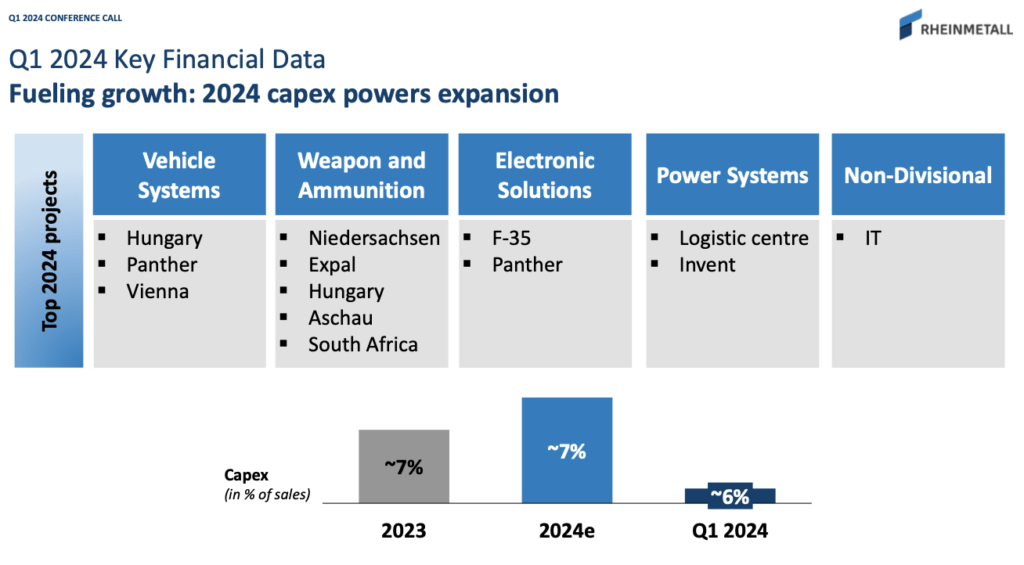

Rheinmetall’s sales grew by 16 percent, reaching approximately €1.6 billion. The Düsseldorf-based company’s first-quarter performance was buoyed by a 43 percent surge in its order backlog, now standing at €40.2 billion, up from €28.2 billion. Rheinmetall’s operating earnings increased by 60 percent to €134 million, with an operating margin improving to 8.5 percent. This growth is attributed to large-scale, multi-year contracts, notably with the German armed forces and other NATO members. According to Rheinmetall Chief Financial Officer Dagmar Steinert, more than 40 percent of annual sales are expected to come in the fourth quarter after Rheinmetall confirmed 2024 sales guidance at around 10 billion euros. Around 77 percent of Rheinmetall’s sales were generated outside Germany. The total order intake and volume of new framework agreements with military customers amounted to €929 million (2022: €913 million, 2023: €603 million). Last year, sales performance was mainly driven by Leopard tank deals. This year’s largest single order is a service contract with the German Bundeswehr to supply up to 123 heavy weapon carrier Boxer 8×8 CRVs for infantry, worth more than €620 million.

SAAB Is Recruiting

The Swedish defense company SAAB has also enjoyed growth in Q1, recruiting over 700 new employees since the end of last year. Its sales amounted to €1.22 billion (2023: €990 million) in the first quarter of 2024, with an organic sales growth of 24 percent. SAAB’s earnings before interest and taxes (EBIT) increased by 28 percent, reaching €103 million (2023: €80 million). The EBIT margin improved to 8.4 percent (2023: 8.1). Order bookings increased by 9 percent, amounting to €1.59 billion (2023: €1.47 billion), driven by strong growth in medium-sized orders. Key orders in SAAB’s first quarter included an RBS 70 NG, Man-Portable Air Defence System (MANPAD) contract to Canada worth €160 million and a support contract for GlobalEye, a multi-domain Airborne Early Warning & Control (AEW&C) solution, to the United Arab Emirates worth €150 million. Additionally, SAAB secured a contract for four Gripen C fighter aircraft for Hungary and an order for the Arexis sensor suite for German Eurofighters. The value of these contracts has not been disclosed. Q2 has started well for SAAB, having already signed its largest Carl-Gustaf and training equipment contract to date with Poland, valued at €1.1 billion.

New Missile Factory for Kongsberg

As the largest player in the Norwegian market, Kongsberg’s future success in its domestic market seems secured as the Norwegian Government unveiled its proposal for a new long-term defense plan spanning from 2025 to 2036. “Kongsberg will play an important role in enhancing and fortifying Norway’s defense capabilities across land, sea, and air domains,” wrote company president and CEO Geir Håøy in Kongsberg’s Q1 2024 quarterly report.

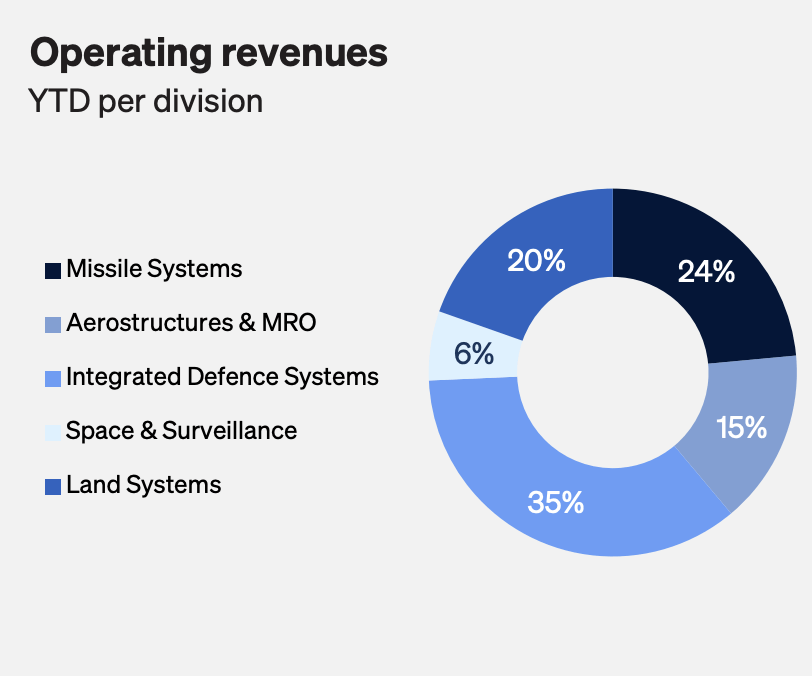

Operating revenues of Kongsberg Defence & Aerospace reached €424 million in the first quarter, up 40 percent from the same quarter last year. All five divisions of Kongsberg Defence & Aerospace experienced robust revenue growth compared to the first quarter of 2023. Approximately €43 million of this growth is attributed to abnormally high delivery volumes in the quarter, an effect isolated to the first quarter of 2024. Both the missile division and the land systems division, which supplies the Remote Weapon Station weapons control system, showed strong growth.

In Q1, Kongsberg signed a contract with the Norwegian Defence Materiel Agency for new NASAMS air defense systems worth €121 million. The company will supply PROTECTOR weapon control systems worth approximately €103.5 million, to be installed on more than 300 Patria vehicles to be delivered to Finland and Sweden. Deliveries will start in 2025 and continue into the 2030s. At the end of Q1 2024, Kongsberg Defence & Aerospace had an order backlog of €5.7 billion, following continuous growth in recent years. Kongsberg will have a new missile factory operational by the summer of 2024. Kongsberg Defence & Aerospace’s long-term EBITDA margin target is 17 percent by 2025, varying between quarters.

PATRIA Will Be Big in Japan

The largest domestic player in the Finnish defense market, Patria, continued its success in 6×6 and 8×8 vehicle programs in Q1 of 2024. This supports the development of other business operations and the group’s aim to become more international. Among other projects, such as a new manufacturing site in Latvia, Patria, and Japan Steel Works Ltd. signed a license agreement on manufacturing Patria AMV XP 8×8 vehicles in Japan.

Patria Group’s net sales in Q1 were €172.1 million (2023: €149.4 million) and operating profit was €5.2 million (2023: €3.6 million). The company reported new orders worth €625 million, with an order stock amounting to €2.4 billion.

The first quarter’s sales highlights included a deal to deliver flight inspection system installation and modification packages to Fintraffic and STC for Finnish Aviation Academy Embraer Phenom aircraft, plus two agreements to supply Patria ARIS electronic intelligence systems (ELINT) to European NATO member countries.

The Common Armoured Vehicle System (CAVS) program was also fruitful for Patria in Q1: the Finnish Defence Forces purchased 40 more Patria 6×6 armored vehicles. In Germany, Patria’s partners DSL (part of KNDS group) and FFG are competing to replace the German FUCHS fleet with German variants of Patria’s 6×6 armored personnel carrier. The Swedish Defence Procurement Agency (FMV) signed a €470 million contract to buy 321 Patria 6×6 vehicles, the largest ever in Sweden for Patria.

From the aviation front, Lockheed Martin and Patria signed their second Memorandum of Agreement (MoA) to establish a production line in Finland to deliver landing gear doors for the global F-35 fleet. A new Patria-led eALLIANCE program with Finnish civilian and defense sector companies aims to develop disruptive digital capabilities for enhanced data sharing and processing, as well as build a holistic metaverse.

Read More:

- Rheinmetall: Rheinmetall reports strong start to first quarter of 2024 – Group continues profitable growth and increases order backlog

- Rheinmetall: Financial Publications and Presentations

- Reuters: Leopard tank maker Rheinmetall rides arms boom but shares dip on profit miss

- ESD: Bundeswehr orders up to 123 Lance-equipped Boxer heavy weapon carrier variants

- Kongsberg: Q1 2024: 26 percent growth and EBIT of NOK 1.46 billion in the quarter

- Saab: Saab’s results Q1 2024: Full steam ahead to grow our business

- Patria: Patria Reports First Quarter 2024 Earnings Results – Patria Group’s Interim Report for 1 January – 31 March 2024

- SIPRI: The SIPRI Top 100 arms-producing and military services companies in the world, 2022